E Invoicing Ksa

Home »

E Invoicing Ksa

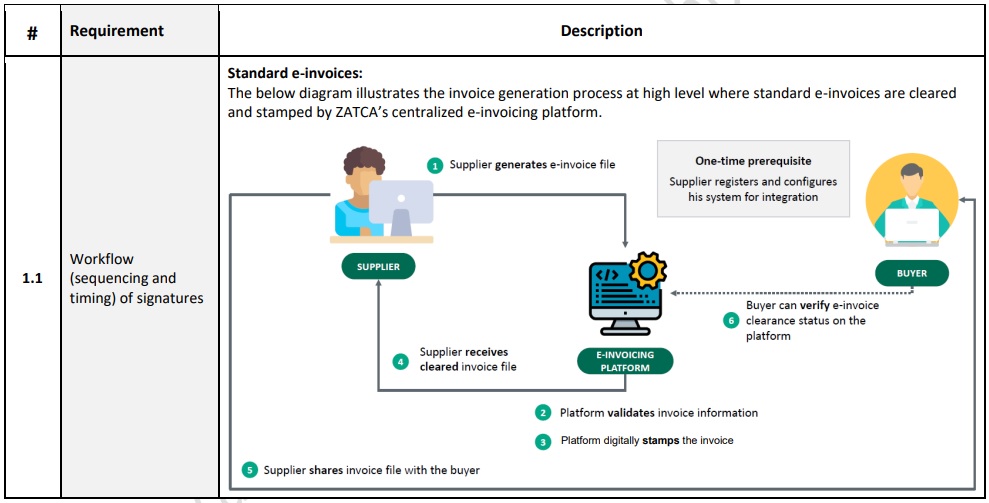

Standard E Invoices

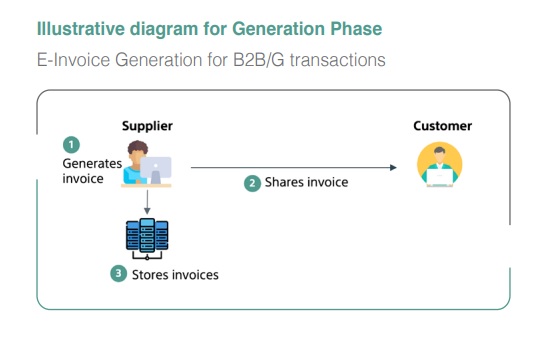

Generation of Electronic Invoices and Electronic Notes

Phase One –

Taxpayers will have to issue electronic invoices with a compatible system that allows the required fields to be represented in the electronic invoice. The system must also archive and generate an electronic copy to the client. Manual invoices will no longer be accepted.

The mandatory fields that must be included in the electronic invoice in Phase One are:

- VAT number of the buyer, if registered as a taxpayer mandated to invoice;

- Issuance date of the invoice and the VAT.

- QR code is must include on the SIMPLIFIED B2C INVOICE & Optionally the seller can add a QR code to B2B invoices.

- Moreover, the accounting programs should have capability to export invoice details in form of xml outputs using the specified UBL schemas.

Phase Two

The Integration Phase on the transmission of Electronic Invoices and Electronic Notes is enforceable starting from January 1, 2023, and implemented in waves by the targeted taxpayer groups.

After this date all invoicing systems must be compatible with the ZATCA system. The integration with the ZATCA’s system will be rolled out progressively based on the taxpayer class. ZATCA will inform taxpayers at least 6 months before their mandatory integration date.

During this phase the following requirements must be followed:

- All electronic invoices including tax invoices or simplified tax invoices and their associated documents must be generated in an XML or PDF/ A-3 (with XML) format.

- The electronic invoicing solution must be able to connect to the internet and integrate with External systems through the ZATCA’s API.

What is E-Invoicing (FATOORAH)?

Electronic invoicing is a procedure that aims to convert the issuing of paper invoices and notes into an electronic process that allows the exchange and processing of invoices, credit notes & debit notes in a structure electronic format between buyer and seller through an integrated electronic solution.

What is an electronic invoice?

A tax invoice that is generated in a structured electronic format through electronic means. A paper invoice that converted into an electronic format through coping, scanning, or any other method is not considered an electronic invoice.

Tax Invoice

An invoice that is usually issued by a Business to another Business (B2B and B2G), containing all tax invoice elements.

Simplified Tax Invoice

An invoice that is usually issued by a Business to consumer (B2C) containing all simplified tax invoice elements.

How does E-Invoicing (FATOORAH) work?

E-Invoicing will be rolled-out in two phases in KSA (more details about the phases here). For the first phase, enforceable as of December 4th, 2021, for all taxpayers (excluding non-resident taxpayers), and any other parties issuing tax invoices on behalf of suppliers subject to VAT, electronic invoice issuance will be very similar to today, with invoices issued through a compliant electronic solution and including additional fields depending on the type of the transaction:

You as a taxable person in Kingdom of Saudi Arabia and subject to E-Invoicing Regulation must note the following:

- You must share with the buyer the Tax Invoice or its associated Notes (Credit/Debit Note) that have been electronically generated.

- You must present to your customers a printed copy of the Simplified Tax Invoice or its associated Notes that have been generated electronically.

- You can share with the buyer an electronic format or any other human-readable format of the Simplified Tax Invoice or its associated Notes upon the agreement between the transaction parties.

- You must generate a QR code for Simplified Electronic Invoices and associated Notes (QR code is optional for Standard Electronic Invoice and its associated Notes for Phase One).

INFORMATION SECURITY

Persons subject to the E-Invoicing Regulation must ensure that their Compliant E-Invoice Solutions must be tamper-resistant and include a mechanism which prevents tampering and reveals tampering attempts that might occur.

The Compliant Solution must be able to protect the generated Electronic Invoices and Electronic Notes from any alteration or undetected deletion and contain some functionalities which enable the taxable person to save Electronic Invoices and Electronic Notes and archive them in XML format without an Internet connection.

Prohibited Functions

Enforced by the Phase One - generation phase (4 December 2021)

CAN NOT DO THE FOLLOWING

• Anonymous access

• Ability to operate with default password

• Absence of user session management

• Allow alteration or deletion of generated e-invoices or their associated notes

• Allow for log modification/ deletion

• Generated with inaccurate timestamps

• Non-sequential log generation

• Invoice counter reset

Enforced starting from the Phase Two- Integration phase (1 January 2023)

• Allow ability to generate more than one

• invoice sequence at any given time

• Export of stamping keys

• Time changes

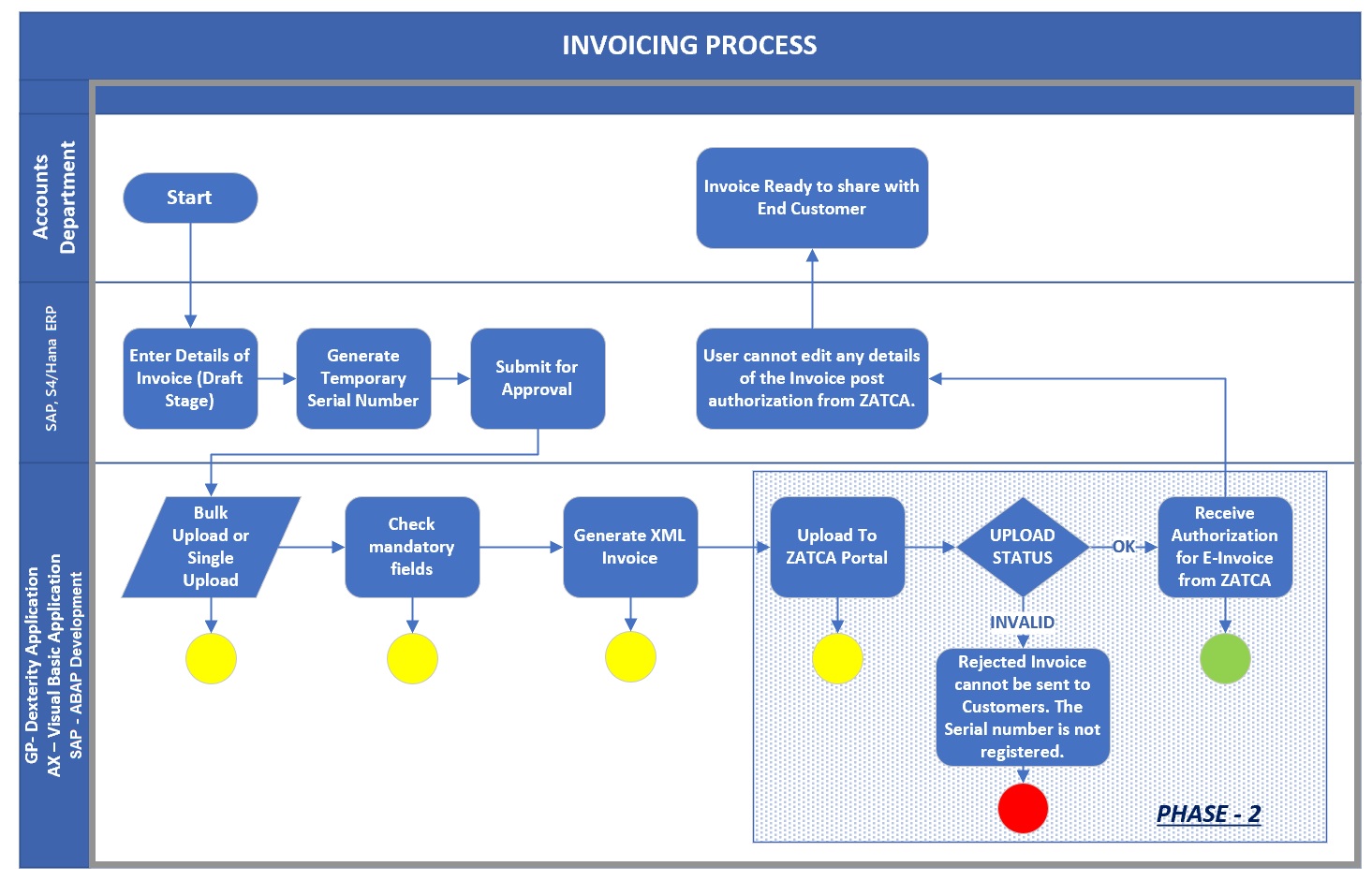

How we can helps customers to be compliant with E-Invoicing Regulation for KSA for Phase One and Phase Two

The critical reasons to implement our E-Invoicing solution for Phase One and Two are as follows:

• Allows you to be compliant with the specifications and requirements as per ZATCA e-Invoicing Regulation after verifying its conformity to all specifications and requirements by ZATCA.

• Helps you to generate Electronic Invoices and their associated Debit and Credit Notes in XML format as per the Provisions of the E-Invoicing Regulation.

• Helps you to generate the QR code and be embedded in the XML format.

• Allows you to extract the QR code using printing programs (such as PDF Forms). This helps the customer to utilize any format as a human-readable format to share the Tax Invoice (printed QR code) with buyers.

• Allows you to share/send the generated XML file with the buyer via email or any other electronic channel.

• Our solution exports e-invoices to a local storage for mandatory archiving. Our solution can generate invoice in the required format by the zatca authority.

• Integration and document exchange with the ZATCA Authority will be done automatically using our solution during the phase two – integration phase.

We provide Complete digital INVOICE MANAGEMENT

• Our Solution is Compliant with E INVOICE AND VAT REGULATION OF ZATCA

• The following aspects are required from the e-invoicing systems used by taxpayers:

• Our E-Invoice solution is non-tamperable

• The ability to protect invoices against any modification or deletion

• The ability to assign a universally unified identification number (UUID) in addition to the number series applied to invoices;

• The ability to create a hash value on all e-invoices and e-notices;

• The ability to apply e-signature to simplified tax invoices;

• The ability to create a QR code;

• Our system contain a counter for e-invoices and e-notices;

• Our system cannot execute any of the prohibited jobs;

• Our system have API connectivity with ZATCA e-invoicing platform;

• Our system must archive e-invoices on servers located in the Kingdom;

• Our system must have passed the conformity tests established by ZATCA.

To discuss your E-Invoicing implementation in compliance with the ZATCA please contact us.

Useful Links

Just Away from You

Moin Bagh, Fatheshah Nagar, Circle 25, Hyderabad - 59, Telangana (INDIA).

+91 99890 55886

Naif Saleh Eid Al Harbi Communication Info Tech.

PO Box 28089 Riyadh 11437.

PO Box 28089 Riyadh 11437.

+966 11 472 8281